On our recent quarterly webinar featuring Samantha McLemore, Founder and Portfolio Manager of Patient Capital and Christina Malbon, Assistant Portfolio Manager, we discuss why the secular bull market remains intact and how extreme market dispersion is creating a prime environment for stock pickers.

We break down why we think AI bubble talk is overhyped, why the bull market is sustainable, the opportunity in Healthcare remains attractive, and our high-conviction thesis on names like Crocs, Amazon, and Coinbase. From our $1M+ long-term outlook on Bitcoin to our strategy of exploiting behavioral mistakes through time arbitrage, we share how we are uncovering growth at a significant discount to the broader market.

Click here for a transcript of the video.

FOR INSTITUTIONAL USE ONLY.

Not for public distribution. This information does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. All investments are subject to risk, including the possible loss of principal. There is no guarantee investment objectives will be met. Neither Patient Capital Management, nor its information providers are responsible for any damages or losses arising from any use of this information.

The views expressed in this commentary reflect those of Patient Capital Management analyst(s) as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. References to specific securities are for illustrative purposes only. Portfolio composition is shown as of a point in time and is subject to change without notice.

Certain information in this presentation may have been obtained from third parties. We make no warranties or representations and disclaim all express, implied and statutory warranties of any kind to the user and any third party, including, but not limited to, any warranties of accuracy, timeliness and completeness. We shall not be liable to user or any third party for lost profits or lost opportunity, direct, indirect, special, consequential, incidental or punitive damages whatsoever, even if we have been advised of the possibility of such damages Nothing herein shall preclude you from any remedies under relevant securities laws.

Certain statements included in this presentation, including, without limitation, statements regarding the investment goals, the Firm’s investment strategy, and statements as our beliefs, expectations or opinions are forward-looking statements within the meaning of the relevant securities laws and are subject to numerous known and unknown risks and uncertainties. The factors discussed herein and throughout this presentation could cause actual results and developments to be materially different from those expressed in or implied by such forward-looking statements. Forward-looking statements generally include the use of words such as "believes," "intends," "expects," "anticipated," "plans," and similar expressions. Undue reliance should not be placed on these forward-looking statements. Actual results could differ materially from those expressed or implied in the forward-looking statements for many reasons, including the risks described herein and the Offering Documents. Such statements relate only to events as of the date on which the statements are made and there can be no assurance that future results, levels of activity, performance, or actual achievements will meet these expectations.

Investors should carefully review and consider the additional disclosures, investor notices, and other information contained elsewhere in this document as well as the Offering Documents prior to making a decision to invest.

Equity securities are subject to price fluctuation and possible loss of principal. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Real estate investment trusts (REITs) are closely linked to the performance of the real estate markets. REITs are subject to illiquidity, credit and interest rate risks, and risks associated with small and mid-cap investments. The strategy may focus its investments in certain regions or industries, increasing its vulnerability to market volatility. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses, and have a potentially large impact on strategy performance. The manager’s investment style may become out of favor and/or the manager’s selection process may prove incorrect, which may have a negative impact on the strategy’s performance. Short selling is a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. The strategy does not invest directly in cryptocurrencies. The strategy obtains indirect exposure to Bitcoin through its holding of the Fidelity Wise Origin Bitcoin Trust (FBTC). Bitcoin and other cryptocurrencies are a relatively new asset class and are subject to unique and substantial risks. Bitcoin is a highly speculative asset that has experienced periods of extreme volatility and may encounter future regulatory changes that may adversely affect its value. Bitcoin is not backed by any government agency. Capital Expenditure (CAPEX) is the money a company spends to buy, upgrade, or maintain long-term assets like buildings, equipment, and machinery. Free cash flow (FCF) is operating cash flow minus capital expenditures divided by the number of shares outstanding. Portfolio holdings and sector allocations are subject to change and are not recommendation to buy or sell any security.

The commentary herein is intended for informational purposes only and does not constitute investment, legal, or tax advice or an offer to sell, or a solicitation of an offer to buy, securities, or an endorsement with respect to any investment strategy or vehicle managed by the Firm.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT, INVOLVES RISK, AND MAY RESULT IN A TOTAL LOSS OF INVESTMENT.

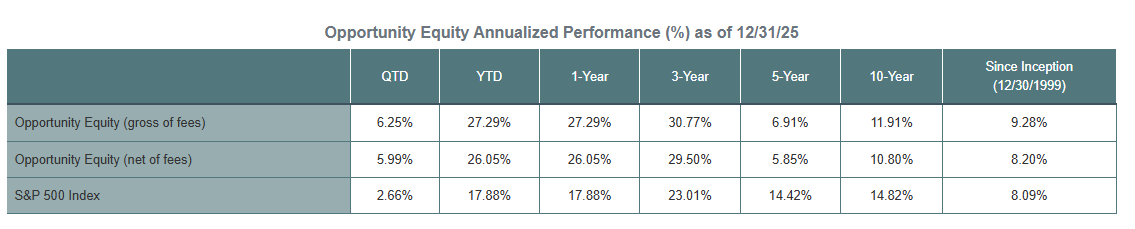

For additional performance information, please refer to the composite GIPS disclosure, which can be obtained by visiting clicking here.

Refer to the full disclosure presentation for important additional information. The returns are for the Opportunity Equity strategy which includes accounts that have utilized derivatives and leverage. Derivatives and leverage will not be used in this program and this difference could materially impact performance.

All investments involve risk of loss and past performance is no guarantee of future results. This material illustrates the investment capabilities of Patient Capital Management and is not a recommendation of any particular investment strategy.

©2026 Patient Capital Management, LLC

Share